24 July 2023

As the new type of 20,000 Kyats banknote will be issued in a limited number as commemoration, and will be distributed only by exchange of the same value with old banknotes, the issuance of new banknote is not associated with a risk of inflation, Central Bank of Myanmar released a statement on 23 July.

Only three banknotes of new 20,000 Kyats will be exchanged with the same value of old banknotes per person in a limited number, it stated.

The Central Bank of Myanmar is mainly underway the monetary policy framework to meet the standard amount by calculating the monetary reserve which should be added in monetary system in accord with the estimated GDP objective, and to support the nation’s economy in performing the monetary policy for reducing inflation and controlling the inflation rate, the statement said.

The CBM has conducted promoting/reducing the reserve requirement ration of other banks which should be added in the CBM rather than increasing the interest rate to be able to carry out the businesses in a momentum.

The CBM has constantly scrutinized the total monetary in the nation’s economy system and has performed abstracting and adding the amount to be stable in the targeted amount in a real time. So, the CBM has adopted moderate strict monetary policy, it stated.

The bank deposit is increasing in the nation’s economy system due to the above methods of monetary policy and ways to preserve and maintain financial sector, and efforts to promote the cash payment and the clarity of bank statement. So, the CBM has increased the disbursement of necessary loans for business enterprise.

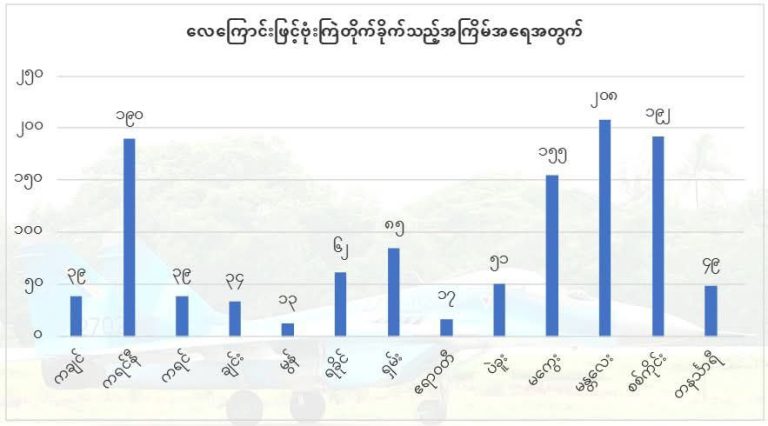

Similarly, the currency in circulation (CIC) rate in the nation’s economy system dropped to 29 percent in 2022 and 11 percent in May, 2023 from 48 percent in 2021.

Moreover, the CBM has primarily undertaken to maintain the foreign exchange rate stability not to occur high inflation through exchange rate.

The CBM has closely observed and scrutinized the inflow of exchange rate and if there are requirements of exchange rate, it allows the banks which performed financing issuing and selling, and bought foreign currency to sell foreign exchange to importers/exporters and entrepreneurs who need foreign exchange. The foreign exchange rate is stable without fluctuation in this current situation.

The current exchange rate which occurred in the online foreign exchange market can be seen between the banks led by Central Bank of Myanmar. As necessary foreign currency can be bought for the importers and exporters in the online foreign exchange market, the necessary import goods which is required in the market, and necessary inputs which is required for the business enterprises can be imported, the statement stated.